ETH Price Prediction: $6,800 Target in Sight as Technicals and Fundamentals Align

#ETH

- Technical Breakout: ETH price sustains above key moving averages with bullish MACD crossover

- Whale Accumulation: 1.8M ETH bought by large investors suggests strong conviction

- Institutional Catalyst: ETF speculation and $1.9B derivatives activity fuel upside momentum

ETH Price Prediction

Ethereum Technical Analysis: Bullish Indicators Emerge

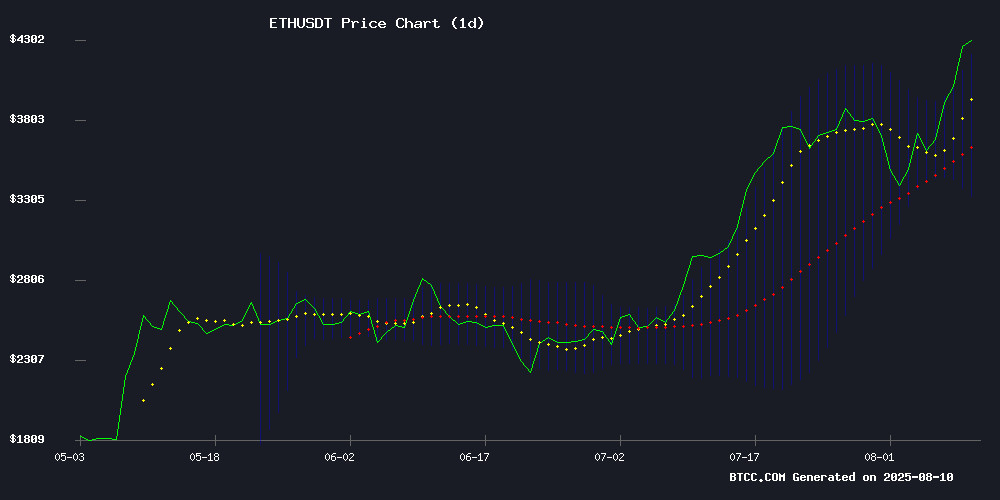

ETH is currently trading at $4,237.41, comfortably above its 20-day moving average of $3,766.69, signaling strong bullish momentum. The MACD histogram shows a positive crossover at 66.9042, reinforcing the upward trend. Bollinger Bands indicate volatility expansion with price hugging the upper band at $4,193.88, suggesting continued upside potential.

Ethereum Market Sentiment Turns Euphoric

Institutional interest is surging as ETH breaks $4,200 resistance, with whales accumulating 1.8M ETH and open interest spiking $1.9B. The ethereum Foundation's legal support for Tornado Cash and Vitalik Buterin's endorsements add fundamental strength. Analysts now eye $6,800 targets following the golden cross formation and ETF speculation.

Factors Influencing ETH's Price

Ethereum Foundation Pledges $500K Match for Tornado Cash Co-Founder's Legal Defense

The Ethereum Foundation has committed to matching up to $500,000 in donations for the legal defense of Roman Storm, co-founder of privacy tool Tornado Cash. A U.S. court recently convicted Storm of conspiring to operate an unlicensed money-transmitting business, with two additional charges—money laundering and sanctions violations—pending potential retrial.

Tornado Cash, a cryptocurrency mixer designed to obscure transaction trails, has been a lightning rod for regulatory scrutiny. The U.S. Treasury sanctioned the protocol in 2022, alleging $7 billion in laundered funds including assets tied to North Korea's Lazarus Group. This case tests the boundaries of developer liability for open-source code used by third parties.

The outcome could establish precedent for how decentralized finance tools are regulated globally. Privacy advocates warn an unfavorable ruling may chill innovation, while regulators maintain such tools enable criminal activity. The Ethereum Foundation's intervention signals the case's importance to the broader crypto ecosystem.

Ethereum's $10,000 Price Target Gains Momentum as Whales Accumulate

Ethereum's bullish trajectory is accelerating, with analysts increasingly confident in a $10,000 price target by 2025. Institutional demand has surged following ETF approvals, while on-chain data reveals whales have accumulated over $1.2 billion in ETH since ETF speculation began.

The cryptocurrency currently trades near $3,600, with traders eyeing $3,817 as a critical resistance level. A breakout above this threshold could catalyze a rally toward $4,000 and beyond. Despite a slight pullback in open interest, positive funding rates indicate leveraged traders remain bullish.

While Ethereum dominates attention, altcoins like $HYPER and Maxi Doge are generating speculation about potential 100x returns. Market participants are balancing long-term ETH accumulation with high-risk, high-reward altcoin plays.

Ethereum Co-Founder Vitalik Buterin Reacts To Visa Decentralization Claims

Vitalik Buterin, co-founder of Ethereum, has drawn parallels between Visa's early cooperative structure and modern decentralized autonomous organizations (DAOs). His remarks came in response to a social media discussion initiated by Polygon's Mihailo Bjelic, who described Visa's origins as a "proto-DAO." Buterin noted that Visa initially operated on principles resembling today's DAOs before evolving into a more centralized, fee-driven model.

The debate emerges amid growing scrutiny of Visa's role in financial censorship, particularly its involvement in restricting certain video game transactions. Platforms like Steam and Itch.io have found themselves at the center of disputes over payment processor policies, reigniting discussions about centralized control in digital economies.

Ethereum’s Rally to $4,200 Sparks Institutional Interest as All-Time High Looms

Ethereum’s surge past $4,000 has ignited bullish sentiment across crypto markets, with institutional players increasingly drawn to its momentum. The asset now eyes $4,500 as its next psychological threshold.

Over $207 million in short liquidations fueled ETH’s 7% single-day gain, creating a feedback loop of buying pressure. Analysts observe a wealth effect cascading into altcoins as portfolio values rise.

"This mirrors previous cycles where ETH leads, then rotates to BTC before a final euphoric top," noted crypto analyst Miles Deutscher. Michaël van de Poppe warned of froth near current levels but conceded the technical setup favors continuation.

Ethereum Price to $6,400 Is Possible If Whales Build on 1,800,000 ETH Buyups

Ethereum's price trajectory could surge to $6,400 if whale accumulation continues at its current pace. Over 1.8 million ETH were purchased by large investors in the past month, signaling potential upward momentum. Market analyst Ali Martinez highlighted this activity on social media, suggesting a breakout if key resistance levels are breached.

The recent buying spree coincides with heightened network activity and technical price pressure. Martinez posits $6,400 as a magnetic target should Ethereum escape its current trading range. While some traders view this as a bullish signal, others await confirmation through increased volume and momentum.

Since August, ETH has oscillated between $3,500 and $3,800. The sudden whale activity introduces volatility potential, though market participants remain divided on immediate breakout prospects.

Ethereum Eyes $5K as Price Hits $4,220; Key Resistance at $4,500 in Focus

Ethereum surged 8.29% to $4,220 amid a 17.41% spike in 24-hour trading volume, reaching $49.95 billion. The asset has gained 21.35% over the past week, reflecting accelerating institutional interest and bullish momentum.

Analysts identify $4,500 as a critical resistance level. A decisive breakout could propel ETH toward $5,000-$5,500 territory, while rejection may trigger a corrective dip to $3,200-$3,400 before resuming upward trajectory. Market participants await confirmation of either scenario.

Vitalik Buterin Endorses ETH Treasury Firms While Warning of Leverage Risks

Ethereum co-founder Vitalik Buterin has expressed cautious support for the rise of ETH treasury firms—public companies accumulating Ethereum on their balance sheets. During a Bankless podcast appearance, Buterin acknowledged these entities broaden access for investors wary of direct crypto custody but emphasized the need to mitigate leverage-related risks.

The trend reflects growing institutional interest, with firms like BitMine Immersion Technologies amassing over 833,100 ETH ($3.2 billion). Wall Street's embrace of such vehicles signals maturation, offering traditional investors indirect exposure to crypto assets.

Ethereum Breaks Out: ETFs, DeFi, and Golden Cross Fuel $6,800 Bull Case

Ethereum surged to $4,170, its highest level since December 2021, driven by record-breaking U.S. spot ETF inflows, institutional accumulation, and robust on-chain activity. Analysts now eye a potential rally toward $6,800 as technical indicators turn bullish.

Spot Ethereum ETF inflows skyrocketed by $326 million this week, marking 14 consecutive weeks of inflows totaling $9.8 billion. BlackRock’s ETHA ETF leads with $9.85 billion in cumulative inflows, while Grayscale’s ETHE ETF faces outflows due to its 2.50% expense ratio.

Institutional demand is further evidenced by entities like SharpLink Gaming, which acquired 22,000 ETH this week. The convergence of ETF momentum, DeFi dominance, and a golden cross formation underscores Ethereum’s bullish trajectory.

Ethereum Breaks $4,200 Resistance Amid Bullish Momentum

Ethereum surged past the critical $4,200 resistance level, trading near $4,223 with an 8% gain in the last 24 hours. The breakout, fueled by strong technical signals and institutional demand, marks ETH's first sustained hold above $4,000 since late 2024.

Analysts highlight the potential for a short squeeze toward $4,500 if momentum holds. The rally coincides with optimism surrounding Ethereum's upcoming Dencun upgrade and a bullish descending wedge pattern breakout on daily charts.

Ethereum Derivatives Market Sees $1.9B Surge in Open Interest Amid Price Rally

Ethereum's derivatives market is experiencing heightened activity as open interest tied to ETH futures and options surged by $1.9 billion within 24 hours. The 8.5% jump brings total open interest to $24.5 billion, according to CryptoQuant analyst Maartunn, signaling aggressive speculative trading.

ETH's price rose 4% during the same period, but open interest grew at more than double that rate—a classic divergence suggesting leveraged positions are flooding the market. Such disproportionate growth often precedes volatility spikes as overleveraged traders face liquidations.

Open interest measures unsettled contracts across exchanges, reflecting both bullish and bearish bets. The metric serves as a barometer for market participation, with rapid increases typically indicating frothy conditions. Traders appear to be positioning ahead of potential ETH price movements, though the buildup of leverage raises risks of abrupt market swings.

Arthur Hayes Reverses Ethereum Position as Rally Defies Expectations

BitMEX co-founder Arthur Hayes executed a dramatic reversal in his Ethereum strategy, buying back at a 17% premium after initially selling during market uncertainty. His $10.5 million repurchase at $4,150 per ETH underscores the asset's violent momentum shifts.

Ethereum's 50% monthly surge to $4,200 has confounded bearish traders anticipating macroeconomic headwinds. The rally flipped institutional sentiment within days, with Hayes publicly joking about abandoning profit-taking strategies altogether.

Is ETH a good investment?

ETH presents a compelling investment case based on current technicals and market dynamics:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +12.5% premium | Strong uptrend confirmed |

| MACD | 66.90 bullish crossover | Momentum accelerating |

| Bollinger %B | 0.98 | Near overbought but not extreme |

With institutional inflows, developer activity, and clear technical breakout, ETH appears positioned for further appreciation. However, traders should monitor the $4,500 resistance level for confirmation.

Past performance not indicative of future results. Cryptocurrency investments are volatile.